Special Drawing Rights (SDRs) –

The SDR is a global reserve asset created by the IMF in 1969 to supplement the official reserves of its member countries. The value of the SDR is determined by a basket of five currencies—the U.S. US Dollar, Euro, Chinese Renminbi, Japanese Yen and British Pound Sterling.

The SDR was established as a supplementary international reserve asset under the Bretton Woods fixed exchange rate system. The collapse of the Bretton Woods system in 1973 and the switch from large currencies to floating exchange rates declined dependence on the SDR as a worldwide reserve asset. However, SDR allocations can play a role in providing liquidity and complementing the official reserves of member countries, as has been the case in the midst of the global financial crisis.

The SDR constitutes the unit of account of the IMF and certain other international organisations.

The SDR is not a currency or a claim against the IMF. Rather, it is a potential claim to the freely available currencies of IMF members. SDRs may be traded against those currencies.

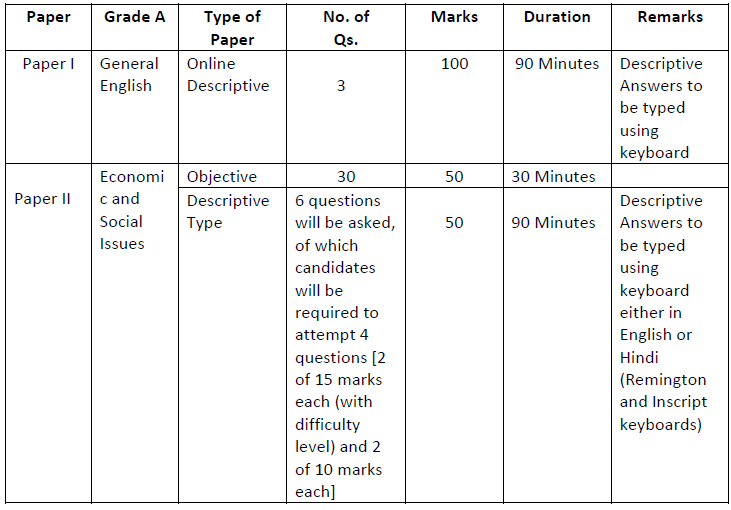

Dear Aspirants, as you know that there is a conspicuous change in the syllabus of the second phase of NABARD Grade A 2021. The weightage of Subjective Type Knowledge is more. In this second phase, you are required to write Descriptive English Questions along with the questions based on Economic and Social Issues. Kindly attempt the following NABARD ESI Descriptive Question